Top Ten Insights for Foundation Investors in a Mature Market

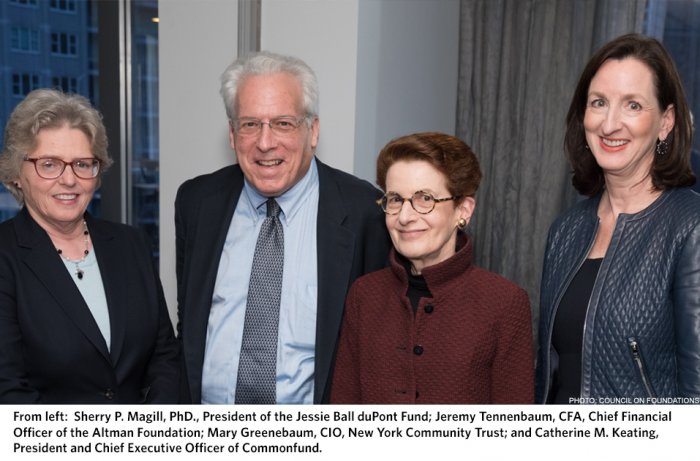

Last week I had the honor of moderating a panel at the 2017 Council on Foundations Endowments & Finance Summit. In the session, “Foundation Investing in Mature Markets: Challenges and Rewards,” I was joined by three esteemed colleagues, representing foundations with over $3 billion in endowed assets and close to three centuries of combined history. My colleagues: Mary Greenebaum, CIO, New York Community Trust; Sherry P. Magill, PhD., President of the Jessie Ball duPont Fund; and Jeremy Tennenbaum, CFA, Chief Financial Officer of the Altman Foundation.

Each of these institutions is a pillar of its community, supporting programs that enrich quality of life and help those in our society that are most in need. The ongoing health of their endowed assets is critical to their ability to support their missions and maintain grant making through market cycles.

Each of these institutions is a pillar of its community, supporting programs that enrich quality of life and help those in our society that are most in need. The ongoing health of their endowed assets is critical to their ability to support their missions and maintain grant making through market cycles.

This session was particularly timely, given the state of the economy and capital markets. We are now in the ninth year of the post-financial crisis expansion and U.S. equity markets are at all-time highs. While we know that bull markets don’t “die of old age,” we also know that they don’t last forever. A correction is inevitable. Our discussion was wide-ranging, covering topics from investment policy, to program-related investing (PRI), to the role of hedge funds in long-term portfolios. Following is my distillation of the top ten investment insights shared by our panelists for this mature phase of the market cycle.

1. Rebalance the portfolio

Institutions have policy guidelines that protect them from the behavioral mistakes of other investors – make sure to follow them.

2. Raise cash for 2018 grants

Having cash on hand to cover one year of grants provides an invaluable cushion against having to redeem at an inopportune time.

3. Consider shortening multi-year grant periods

Given the focus and commitment to the mission, this can be difficult, but may be a prudent strategy.

4. Spend less than 5%

If you have excess distribution carryforwards take advantage of them.

5. Manage costs

We can’t control the markets but we can control our costs. Every dollar saved can help to fund the mission.

6. Review return assumptions

Confirm that your assumptions are still reasonable and make sure to be looking forward instead of back.

7. Understand key risks

Define the key risks for your organization and make sure to socialize them with the investment committee and your board. It’s also a good idea to conduct scenario tests before a crisis happens so that everyone knows and agrees on what steps will be taken when the time comes.

8. Evaluate PRIs

Program related investments can be an effective way to place loan capital in the community and further the mission.

9. Align investments to mission

This can range from investing in a facility that serves your constituents to aligning investments with your institution’s environmental, social, and governance (ESG) goals.

10. Source liquidity

Understand the liquidity constraints imbedded in the portfolio and think creatively about how to source liquidity if the need arises, including possible use of credit lines.

This is list is by no means exhaustive but it is an appropriate place to start. As Alexander Graham Bell said, “Before anything else, preparation is the key to success.”