A Case of Impact Investing

Economic development is at the center of the Maine Community Foundation’s strategic priorities. We believe greater access to lower cost capital will allow entrepreneurs and innovators from both the nonprofit and for-profit world to grow enterprises and expand projects that build off our natural assets, revitalize our downtowns, and strengthen our economy.

To make that happen, the foundation is partnering with its donors to build two new impact investing pools that will focus first on impact and second on generating returns. The Farms, Fisheries and Food pool is improving access to capital for entrepreneurs and organizations working in agriculture- and fisheries-related businesses and projects. The Downtown and Business Development pool is directing capital to businesses and nonprofits, especially in underserved markets, to support enterprise development and improve downtown buildings. A recent agriculture-related investment illustrates how the foundation is putting impact investing capital to work to help farmers expand markets. Maine’s agriculture sector needs to expand value processing and its ability to get higher value products to consumers in larger markets. Increasing supply will also help meet growing demand: a found that 24% of Maine people cited “lack of access” as to why they don’t buy more local food. Satisfying this growing demand requires investing in enterprises that will develop new products and distribution networks.

A recent agriculture-related investment illustrates how the foundation is putting impact investing capital to work to help farmers expand markets. Maine’s agriculture sector needs to expand value processing and its ability to get higher value products to consumers in larger markets. Increasing supply will also help meet growing demand: a found that 24% of Maine people cited “lack of access” as to why they don’t buy more local food. Satisfying this growing demand requires investing in enterprises that will develop new products and distribution networks.

The Fair Food Fund, a new regional fund under the nationally recognized Fair Food Network, is focused exclusively on providing financing and technical assistance to businesses seeking to meet this growing demand for locally grown food. This year the Maine Community Foundation made a $250,000 investment in the Fair Food Fund and provided grant support for its technical assistance activities. Together, we will track the extent to which providing financing and technical assistance in these types of business will result into new jobs and economic activity.

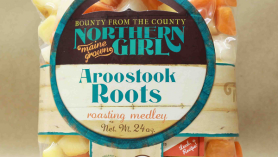

Using capital from the Maine Community Foundation and other impact investors, the Fair Food Fund recently made a $230,000 loan to Northern Girl, an Aroostook county-based company that processes and distributes root crops from Maine farmers to retail stores and institutions across New England. The company primarily works with smaller farmers, helping them distribute the highest value crop on the fresh market and process the surplus into value-added products. Loan funds from the Fair Food Fund will be matched by $200,000 in private capital raised by Northern Girl and will be used to finance equipment for its new facility to produce and freeze one its key products, potato wedges.

In Maine, relationships matter and partnerships are easily formed. As this example illustrates, impact investing is about relationships and is most effectively deployed through partnerships. That’s why conditions in Maine are ideal for this type of philanthropy and investing. It’s producing results now and holds even greater promise to expand the reach and impact of philanthropy in Maine.

Peter Taylor is vice-president for program development and grantmaking services at the Maine Community Foundation.